Press Releases

Scientifica Venture Capital and Lazio Innova announce a new investment in OhmSpace

Scientifica Venture Capital has announced the successful lead of the investment closure in OhmSpace, an avant-garde start-up revolutionizing the aerospace sector.

Joining them in the round is Innova Venture – the venture capital fund funded by the Regione Lazio – and Galaxia the National Aerospace Technology Transfer Hub initiated by the CDP Venture Capital’s Technology Transfer Fund in collaboration with Obloo Srl.

Scientifica Venture Capital has disclosed its ninth investment, aimed at enhancing the growth of OhmSpace, a pioneering aerospace start-up. The aerospace industry comprises companies involved in the development and production of space vehicles – such as satellites of various sizes, including CubeSats – playing a significant role in Earth observation, communication, and meteorology applications. The increasing number of space exploration missions has led the industry to face a growing demand for advanced electric propulsion systems. It is projected that the global space propulsion market will grow from € 7 billion in 2021 to € 12.1 billion by 2025.

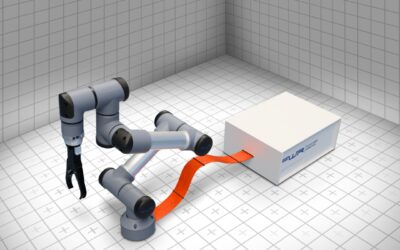

OhmSpace stands out for introducing an innovative high-temperature electric propulsion system based on resistojet technology. Resistojets use the electric power supplied by the satellite (collected from solar panels, stored in batteries, and managed through a power distribution system) to electrically heat a gas. The thermal energy accumulated by the gas is converted into thrust through a thermodynamic process that expands the gas at very high speeds (up to 30,000 km/h for hydrogen). The higher the speed of the exiting gas, the less propellant is needed for a given maneuver. OhmSpace’s high-temperature solution offers performance up to 70% more efficient than competing resistojets on the market, representing a significant improvement in reducing the amount of propellant needed for space maneuvers. Furthermore, by surpassing the performance of chemical thrusters, OhmSpace eliminates the need for toxic propellants for many missions, replacing them with inert gases or water, thus offering more sustainable solutions.

“The decision to invest in OhmSpace reflects our constant pursuit of revolutionary innovations in the space technology sector,” says Riccardo D’Alessandri, Managing Partner of Scientifica Venture Capital. “OhmSpace has demonstrated an extraordinary approach in redefining the limits of space exploration through cutting-edge technological solutions. We are excited to support their journey and actively collaborate in their future development.”

The new investment round will enable OhmSpace to further accelerate its growth, enhance research and development, and expand its market presence. With the financial support and expertise of Scientifica Venture Capital, OhmSpace looks to the future with confidence, anticipating the rapid integration of high-temperature resistojet technology into satellites and paving the way for a more efficient and sustainable space sector. In the aim of increasing the efficiency and sustainability of the space sector, OhmSpace’s founder and CEO, Federico Romei, based his doctoral research conducted at the University of Southampton on the electric propulsion system (resistojet), which led to the birth of the OhmSpace project.

It is also noteworthy that after significant international experience, Romei will establish the leadership of OhmSpace in his home country, precisely in the Lazio region, the heart of the Italian aerospace sector. His return sends a strong and positive message to Italian scientists and entrepreneurs residing abroad, highlighting that Italy can offer concrete and stimulating opportunities to those eager to contribute to the scientific and technological progress of the nation.

“The financial support from Scientifica Venture Capital plays a crucial role in advancing our mission to make space more accessible and sustainable,” stated Romei. “We are excited to collaborate with Scientifica Venture Capital, Lazio Innova and Galaxia, leveraging their expertise in the sector to achieve new milestones and accelerate our growth. I am pleased to announce our next step, which will include establishing a production facility in Italy while maintaining a strong presence in the United Kingdom to continue developing our technology.“

The legal firm Hi.lex Avvocati Associati assisted the investors, while the start-up OhmSpace received legal assistance from the Laward firm.